Why invest?

Investing is the key to creating wealth. An investment in the stock market can deliver both dividends (income) and growth (an increase in the value of your initial investment).

With as little as ₱ 20,000 you can open an account with us and start investing, but any money invested in stocks must not be required for daily needs or recurrent expenses such as rent or tuition.

You can invest to fulfill a short term goal such as buying a car or taking an overseas trip. Or you can invest for the longer term, to buy a home, to pay for your children's education, to fund other investments, prepare for your retirement or simply to be more financially secure, to create the proverbial "nest egg".

What are your investment goals?

You can invest for income or growth or both.

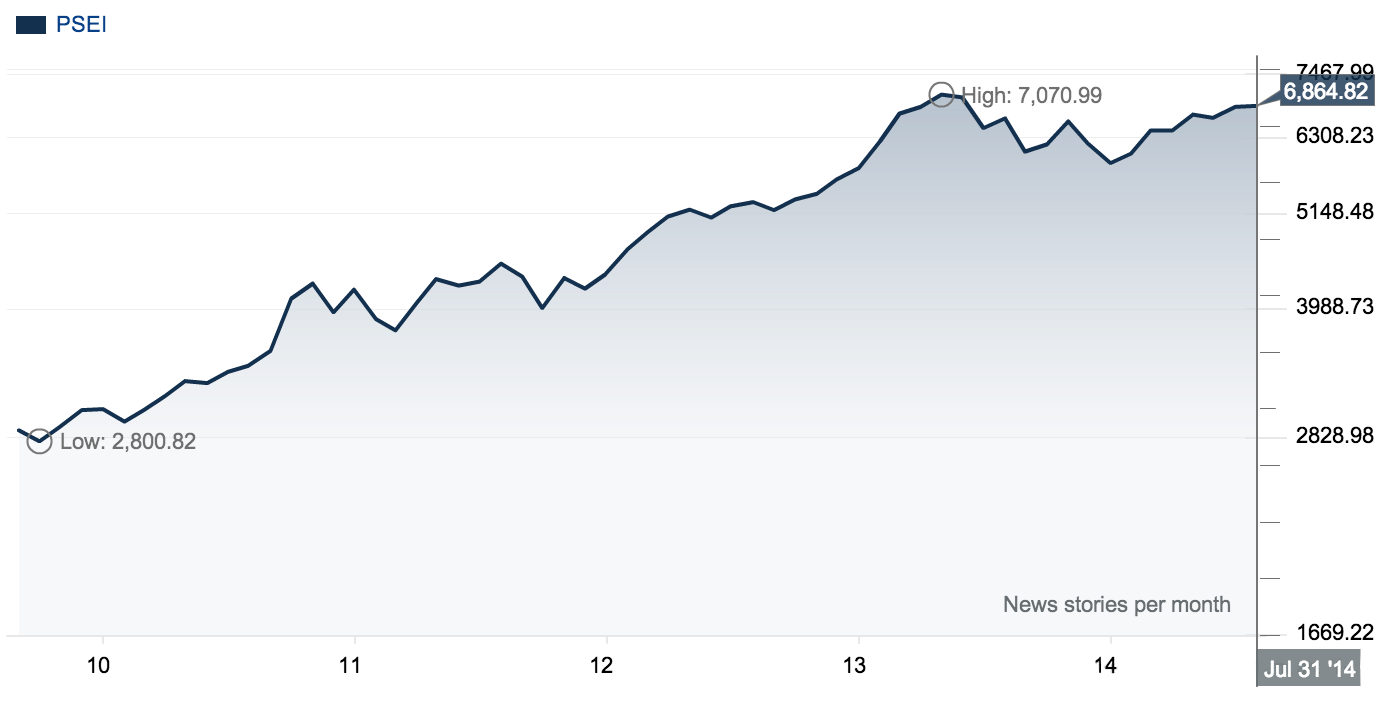

For the PSEi index, which tracks the major companies listed on the Philippine Stock Exchange and is broad based (that is including companies representing all sectors such as mining, industrials, financials etc.), the compounded annual returns - AVERAGE INCOME - over 1, 3, 5, 10 years were 33%, 24%, 10%, 19% respectively. This means that if you had invested in a broad range of shares over these periods, these COULD have been your rates of income over that time. Please note however that these are averages and are not indicative of any particular stock or group of stocks.

Source: quotes.wsj.com

In the last 4 years alone (2010 - 2014), the PSEi has achieved a compounded annual growth rate - INCREASE IN VALUE OF STOCKS - of 19.25%.

But the market will always be cyclical, that is, it will always have UPS and DOWNS. In order to maximize the value of your investment and ride through these ups and downs, you must follow the:

SOUND RULES OF INVESTING

1. Do your own research

We will always assist and offer advice on request but you should try to gain your own knowledge of the companies you are investing in. For example, research their average profits over the last few years, learn how their business is developing and what their future plans are. Learn more about the officers and directors who make important decisions for the company.

2. Know your appetite for risk

If you are conservative, you can invest passively by buying stocks in leading stable companies with a history of delivering income and growth. If you are willing to take on more risk, you can invest more agressively, buying and selling on the cyclical highs and lows. We can help you better understand your risk profile.

3. Diversify

As you build your investments, you should have them in a range of different categories, perhaps some cash savings, term deposits, shares, real estate and bonds. If you buy stocks, you should also try to buy different categories such as industrial companies, banks, mining and resources, property and retail companies. This spreads your risks and improves your chances of achieving income and capital growth. Talk to us about choosing the best mix of stocks for your situation and needs.

4. Don't try to time the market.

No matter how well you have done your research, markets, just like people, will sometimes behave irrationally. Don't overreact when a market movement happens. Assess the situation calmly. Reacting without reflection to market movements can lead to financial losses which can be avoided. The old adage is : "It's not timing the market, it's time in the market".

5. Don't react to rumors.

Just because a relative, friend or neighbor gives you news about a stock, unless that person is knowledgeable and qualified, that news is likely to be wrong and can lead to losing you money. Consult a qualified securities professional or other qualified financial adviser and above all avoid the two negative motivations in stock investing: FEAR and GREED.

Example of buy & sell transactions

Buying Transaction:

A client wants to BUY a stock whose market price is P20.00 a share. If he buys 1,000 shares his required cash outflow will be as follows:

| Market Price/share | ₱ | 20.00 |

| Number of shares to be bought | x | 1000 |

| Transaction Value | ₱ | 20,000.00 |

| Broker's Commission* (1.00% of Transaction Value) | + | 200.00 |

| BIR - Value Added Tax (VAT) 12% of Commission | + | 24.00 |

| SEC Fee (Transaction Value x 0.005%) | + | 1.00 |

| PSE Transaction Fee (Transaction Value x 0.005%) | + | 1.00 |

| SCCP Fee (Transaction Value x 0.01%) | + | 2.00 |

| TOTAL CASH OUTLAY | ₱ | 20,228.00 |

*Broker's Commission varies depending on value of transaction, with a maximum allowable commission rate of 1.5%

**If a buying client chooses to be issued and maintain a physical certificate in his/her name, an upliftment fee of P50.00 per certificate issuance request and transfer fee of P100.00 + 12% vat will be charged.

Selling Transaction:

A client wants to SELL a stock at P25.00 per share. If she sells 1,000 shares her cash inflow will be as follows:

| Market price/share | ₱ | 25.00 |

| Number of shares to be sold | x | 1000 |

| Transaction Value | ₱ | 25,000.00 |

| Broker's Commission (1.00% of Transaction Value) | - | 250,00 |

| BIR - Value Added Tax (VAT) 12% of Commission | - | 30,00 |

| Stock Transaction Tax* (Transaction Value x 0.5%) | - | 125,00 |

| SEC Fee (Transaction Value x 0.005%) | - | 1,25 |

| PSE Transaction Fee (Transaction Value x 0.005%) | - | 1,25 |

| SCCP Fee (Transaction Value x 0.01%) | - | 2,50 |

| NET CASH RECEIVABLE | ₱ | 24,590.00 |

*Stock Transaction Tax levied on sellers only.

**If a selling client has certificates, he/she needs to have this converted into book-entry form in the PCD system.

A cancellation fee of P20.00 + 12% VAT and transfer fee of P100.00 + 12% VAT will be charged.